Stamp duty is a tax that must be paid on tenancy agreements in Singapore. This tax is paid to the Inland Revenue Authority of Singapore (IRAS) and is required for the tenancy agreement to be valid. This applies to both new tenancy agreements and renewals or extensions of existing tenancy agreements. In order to make a stamp duty payment in Singapore, the payment must be made within 14 days of signing the tenancy or renewal document.

The stamp duty rate for tenancy agreements in Singapore depends on the length of the tenancy period. For tenancy periods of 4 years or less, the stamp duty is 0.4% of the total rent for the period. For tenancy periods longer than 4 years, the stamp duty is calculated as 0.4% of 4 times the Average Annual Rent (AAR).

To proceed to make your stamp duty payment, follow the steps below.

Walk me through the process!

Just follow the steps below and easily get your tenancy agreement stamp now!

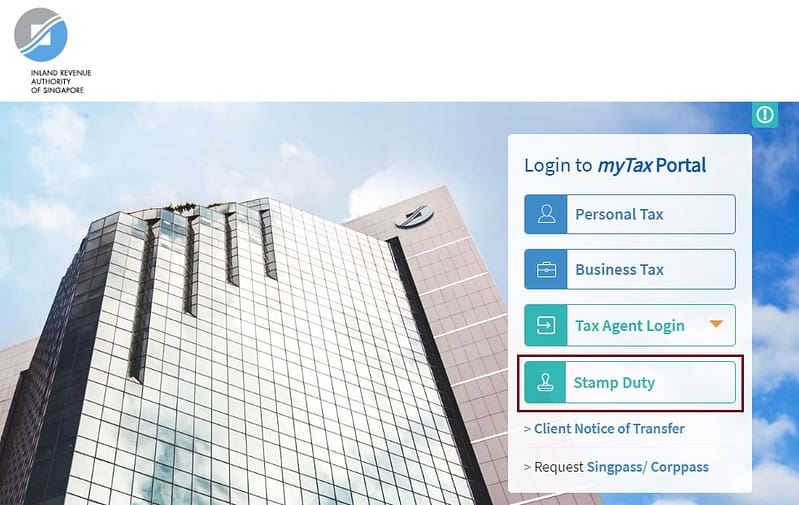

1. Visit IRAS website

Click on the button below or visit https://mytax.iras.gov.sg/ to start and click on Stamp Duty.

2. Click on Individual User and log in with your Singpass

3. Select the header and choose Stamping > Lease & Tenancy

4. Under Nature of Transaction select Lease/ Tenancy Agreement

Under Document Description select Tenancy Agreement

Click Skip to proceed.

5. Fill up all required information and click continue to proceed.

6. Double check the info entered on the Summary page and click Submit to IRAS to proceed with payment.

7. Select your preferred payment mode to continue.

8. Download the stamp certificate for safe keeping.

What If I'm Late At Making Payment?

If a tenancy agreement in Singapore is not stamped, it will not be legally binding in the event of any disputes or conflicts between the landlord and tenant. It’s important to pay stamp duty on time in order to avoid this issue and ensure that the tenancy agreement is valid. Not paying stamp duty is also considered tax evasion in Singapore, and the Inland Revenue Authority of Singapore (IRAS) may take action against those who do not pay.

If stamp duty is not paid within the required time period, IRAS may impose late payment penalties. For late payment within 3 months of the due date, the penalty is $10 or an amount equal to the stamp duty due. For late payment beyond 3 months, the penalty increases to $25 or 4 times the amount of the stamp duty due.